What Is an Internal Audit? Functions, Benefits, and Best Practices!

Great leadership and clear strategy are essential, but accountability, strong controls, and effective risk management build long-term organizational success. The internal audit function remains at the core of this foundation. An internal audit isn’t just about finding mistakes; it serves as a critical, independent process that enhances procedures, ensures stakeholder compliance, and drives organizational efficiency. In every sector, from banking to manufacturing, internal audits manage risks, use resources wisely, and maintain trust. This comprehensive guide will clearly define what an internal audit is, detail its objectives, process, and categories, analyze the essential Five C’s, and explore the future trends shaping the role of internal auditors.

What Is an Internal Audit?

In its simplest form, an internal audit is an independent, objective assurance and consulting endeavor meant to assess and enhance an organization’s risk management, control, and governance practices. The Institute of Internal Auditors (IIA) states that internal auditing assists organizations in meeting their goals by introducing a systematic, disciplined method of evaluating effectiveness. Basically:-

- Verifies whether the company is doing what it claims to do.

- Focuses on compliance (are we doing the right thing according to the rules?) and efficiency (are we doing the best thing possible?).

- Makes suggestions for improvements.

Key Features of a Good Internal Audit

The effectiveness and reliability of a strong internal audit start with commendable features of the auditing tool. These attributes ensure that auditors deliver valuable, clear, and practical information.

Independence

Independence Internal auditors must not be biased. They should report to top management or the board. Independence also safeguards credibility by ensuring impartial evaluations. Personal or organizational pressure can easily bias audit findings, compromising their credibility when independence is lacking.

Objectivity

The results are never based on personal opinion and preference but on evidence. Objectivity ensures that facts and documentation back all conclusions. Consequently, this instills trust in stakeholders, and the audit reports are fair, transparent, and reliable for informing decision-making.

Consultative

An internal audit exposes weaknesses and suggests solutions. A consultative approach strengthens management’s response and enhances systems. Therefore, auditors can operate as partners through this dual role, adding value beyond compliance checks.

Purpose of Internal Audit

Internal audit is not just about catching fraud or mistakes; its purpose is deeper. Its main objectives include:

Risk Management

It acknowledges risks to operations, reputation, or finances. Early detection enables organizations to prepare and minimize exposure. Thus, proactive risk monitoring is attained to provide risk monitoring resilience.

Compliance

The auditors ensure compliance with laws, regulations, and internal policies through reliable safety and compliance software. High compliance evades fines and negative publicity, enhancing an organization’s integrity.

Operational Efficiency

The internal audit identifies inefficiencies in the processes and suggests ways to improve them. This knowledge will reduce waste, save money, and help utilize resources more efficiently. Ultimately, efficiency in this way also boosts competitiveness.

Asset Protection

Auditors protect the company’s assets against abuse or embezzlement with the help of efficient asset management software. Conservation of resources keeps finances afloat, and the securement of assets ensures long-term sustainable growth.

Assurance to Stakeholders

Internal audit assures management, investors, and regulators. Reliability assures trust. Furthermore, it shows accountability on all organizational levels.

An organized internal audit department serves as the organization’s immune system, continuously surveying and rectifying potential dangers before they can cause harm.

The Role of Internal Auditors

Internal auditors are individuals responsible for conducting audits within an organization. They also provide analysis and risk assessment services, as well as advisory services. The most important tasks that internal auditors perform are the following:

Process Reviews

Auditors review workflows and financial practices to identify weaknesses. This helps uncover inefficiencies and ensures resources are used effectively. Careful reviews strengthen organizational stability.

Control Testing

Internal auditors evaluate how well controls function within departments. Effective controls prevent fraud, errors, and noncompliance; strong testing improves confidence in overall risk management.

Risk Assessments

Auditors identify potential threats in daily operations. Early detection reduces vulnerabilities and prepares organizations for change. Anticipatory tests protect business continuity.

Audit Reporting

Auditors prepare a summary of the results of the audit in clear reports. They also come with recommendations for improvement. This helps the management in decision-making, while trust is promoted in a well-documented process.

Management Collaboration

Auditors work together with leaders to embrace better processes. Teamwork ensures a pragmatic approach to solutions. This collaborative work increases compliance and enhances operational efficiency.

Ethical Oversight

Auditors verify compliance with ethical standards. Ethical control should safeguard the company’s reputation and ensure it does not engage in misconduct. Well-developed values develop an organizational culture of integrity.

Internal auditors are occasionally referred to as an organization’s watchdogs, not in a negative sense, but rather as a means of mitigating risks, inefficiencies, and non-conformities.

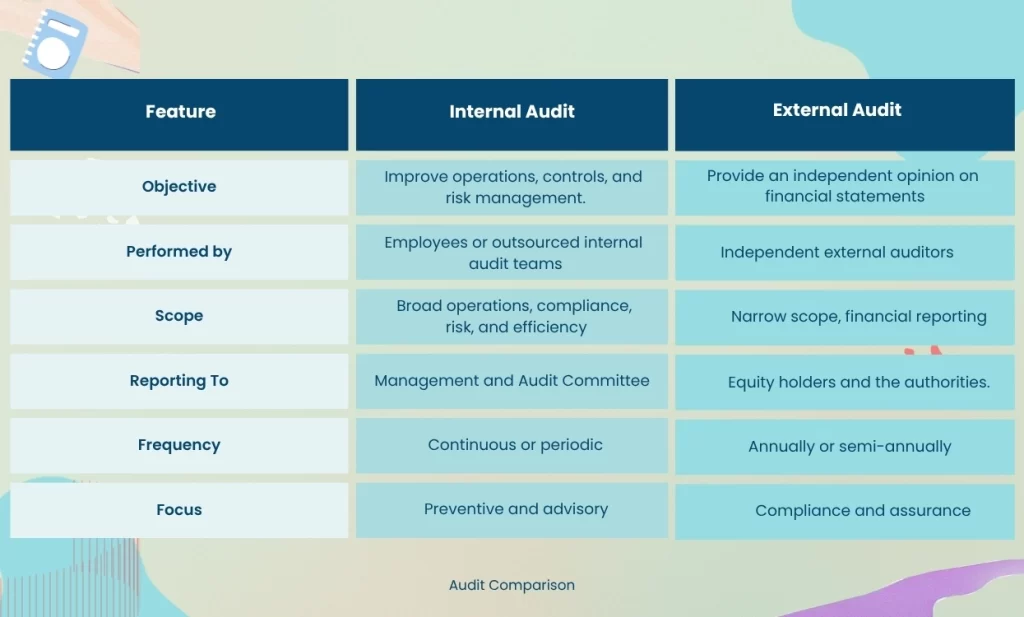

Internal Audit vs. External Audit

The internal audit and external audit can be confused, but their uses are not similar. Here are the differences.

The two are critical: internal audits help improve systems internally, whereas external audits ensure systems are sound externally.

Types of Internal Audit

Here are the different types of internal audit. They help organizations reduce risks, increase efficiency, and comply. These types are intended to meet specific needs.

Financial Audit

This audit examines whether the financial statements are correct and meet the standards. It also determines fraud risks. Ultimately, good financial audits guard the integrity of the company.

Operational Audit

Operational audits, audit daily processes. They identify inefficiencies and propose solutions, thereby enhancing effectiveness and streamlining work processes.

Compliance Audit

Auditors perform this type of audit to make sure that rules, laws, and policies are adhered to. They minimize legal risks and generate credibility and trust in organizations.

IT Audit

IT audits test the system controls, data protection, and cybersecurity. They secure classified information and are very important in the present online activities.

Environmental Audit

The audit assesses green activities and environmental conformance. It reduces environmental hazards, and the green standards increase the credibility of companies.

Forensic Audit

A forensic audit looks into fraud or corruption. It identifies and retains the traces of wrongdoing. This type of audit is significant in litigation.

Performance Audit

Performance audits measure value for money. They verify resource efficiency and enhance the organization’s long-term efficiency.

Pro Tip: Many companies do not separate various forms of audit; instead, they blend them into hybrid internal audit programs.

Internal Audit Process

The internal auditing procedure is designed to give credible results. It has five key steps, from planning to follow-up. Every step guarantees the identification of risks and, accordingly, the achievement of improved results.

Step 1:- Planning:

Planning Auditors set the scope and objectives of the audit. They pinpoint major risks, establish priorities, and design an elaborate audit program. An effective program is also set.

Step 2:- Fieldwork:

The data is collected using interviews, document reviews, and system testing streamlined with form automation software. Each finding is recorded accurately.

Step 3:- Analysis:

Assess evidence against standards to identify weaknesses, risks, and root causes for corrective measures.

Step 4:- Reporting:

The team gathers findings and suggestions in the form of a report. Internal audit management reviews the draft, and responses are given. Finally, the report is shared with the stakeholders.

Step 5:- Follow-Up:

The auditors verify the implementation of recommendations, verify the adequate measures, and observe improvement to ensure that progress is achieved in the long term.

Ultimately, all steps, such as planning and follow-up, ensure that discoveries lead to real changes. When well-executed, the process enhances accountability, improves efficiency, and fosters long-term trust with stakeholders.

The Five C’s of Internal Audit

The Five C’s of Internal Audit are commonly organized to structure the audit results. They are:

- Criteria: The benchmark for judging performance (policy, law, or best practice).

- Condition: What the audit actually found out.

- Cause: Why the gap occurs (e.g., poor training, weak controls).

- Consequence: The risk or effect if it is not corrected.

- Corrective Action: The suggestions to correct the issue.

This structure will ensure that reports are concise, realistic, and business-oriented.

Introducing the Internal Audit Report

The internal audit report is the final product of audit procedures. These provide evidence-based reviews and suggestions to the management. This part summarizes the audit. It highlights key findings and provides a general evaluation. Leaders resort to it as a source of fast information.

Scope & Objectives

In this case, auditors provide information about what was reviewed and why. Scoping and goal setting keep things on track and explain the audit’s aim.

Methodology

This section describes how evidence was gathered. Approaches can include document reviews, interviews, and system tests. Openness will enhance trust in outcomes.

Findings

The results have problems, threats, and opportunities. All conclusions are backed up. A clear presentation helps the management understand the effects of every issue.

Recommendations

Recommendations contain remedial measures. They are practical and problem-oriented. Good suggestions can assist management in augmenting controls and becoming more efficient.

Benefits and Challenges of Internal Audit

Internal audits offer companies important control. They identify risks, maintain operations, and efficiently manage them. In addition to preventing risks, they also improve financial accuracy, accountability, and long-term stakeholder confidence.

The benefits of having good internal auditing are numerous:

Benefits of Internal Audit

- Enhanced Risk Management: One method of ensuring law and regulation compliance is through audits. They trimmed down financial fines and regulatory penalties. Compliance increases the credibility and stability of the organization.

- Improved Compliance: Audits ensure adherence to laws and regulations. They reduce penalties and regulatory fines. Compliance strengthens organizational stability and credibility , especially when aligned with international standards like OHSAS 18001.

- Operational Efficiency: Audits enhance unproductive operations. Organizations can gain production through wastage. Saving time and resources is accompanied by efficiency improvement.

- Financial Accuracy: Auditors guard against fraud and misstatements in reporting financial statements. Good documentation backs up effective business decisions. Accuracy enhances investor and other stakeholder confidence.

- Increased Trust: Regular audits establish confidence among the stakeholders. Open practices are likely to appease investors, regulators, and managers. Confidence brings about long-term growth and sustainability.

- Employee Accountability: Internal auditing encourages departmental ethics. If employees know that the controls are monitored, they will be accountable. Responsibility improves the work environment.

Challenges of Internal Audit

Irrespective of its advantages, internal audit is resistant to some common challenges:

- Resource Limitations: Small audit teams may lack knowledge and equipment. The scarcity of resources lowers coverage. This can be a bane to risk management within an organization.

- Data Complexity: Big data and AI systems require advanced auditing capabilities, and traditional methods often fall short. Therefore, auditors are expected to have specialized training and access to advanced technologies.

- Employee Resistance: Employees may see audits as a punitive measure. A state of confusion leads to resistance. Communication will help create a sense of collaboration and remove stress.

- Regulatory Complexity:

The standards of compliance of international businesses are different. It is difficult with regular changes in the regulations. The auditors must be at par with the times to be effective. - Maintaining Independence: Auditors are forced to balance between objectivity and organizational affinity. Freedom gives a material outcome. Good governance protects independent internal audits.

The solutions to these challenges in forward-thinking companies are training, automation, and effective communication.

Internal Audit in Different Industries

Internal auditing is industry-specific:

- Banking/Finance: Increases the level of compliance and fraud prevention.

- Healthcare: Guarantees the safety of patient data, billing, and medical compliance.

- Manufacturing: Quality and reliability of the supply chain are given.

- Retail/E-commerce: Prevents inventory loss and enhances cybersecurity.

- Government and Public Sector: Ensures transparency and accountability regarding public money.

Audits are tailored to each sector based on risks and compliance requirements. Using reliable safety management system software helps standardize these audit processes across industries.

The Future of Internal Audit

The internal audit role no longer limits itself to the usual checks. Changing technology, globalization, and increased stakeholder expectations rapidly transform it. Organizations demand that internal auditors deliver proactive rather than retrospective analysis.

- Data Analytics: It helps auditors analyze transactions immediately rather than sampling small amounts of data. It improves precision and speed, thereby identifying risks and anomalies more quickly.

- Artificial Intelligence (AI): AI-based auditing automates repetitive tasks such as testing data and matching transactions. It is also predictive because it identifies untold anomalies and patterns humans cannot easily notice.

- Continuous Auditing: Continuous monitoring is replacing annual reviews, as internal audits have become more frequent nowadays. It gives the organizations real-time assurance and reduces the time distance between identifying the risk and solving it.

- Cybersecurity Focus: The need for IT and cybersecurity audits grows because cyber threats are increasing. Companies must protect their data and control who accesses it. Specifically, internal auditors verify data safety, control effectiveness over access, and ensure teams follow security rules.

- Environmental, Social, and Governance (ESG): The demand for stakeholders in sustainability and ethics is increasing. Internal audit is now assessing ESG practices, carbon reporting, and workplace diversity to ensure companies comply with world standards and expectations.

Agility, technology, and expanded responsibility are the future of internal audit. With the adoption of AI, analytics, and ESG management, auditors will no longer be compliance specialists but will consider themselves strategic collaborators in creating resilient, transparent, and sustainable organizations.

Conclusion

Internal audit is no longer a back-office activity; it is now a key facilitator of success. It provides organizations with the tools to work effectively and ethically by systematically evaluating processes, risks, and compliance. In addition to ensuring financial accuracy and operational efficiency, internal audit reports provide practical, actionable insights to preserve assets and instill trust. With the development of technology, internal auditing will be more anticipatory, information-based, and resiliently necessary. A well-developed internal audit function is important to an organization’s survival and necessary. Take the next step toward proactive compliance with Safety Management System Software . A digital solution that enhances transparency, efficiency, and data-driven decision-making across your organization.

people Also Ask

Internal auditors review operations, check financial and operational controls, and determine whether systems operate successfully. They also uncover weaknesses and provide suggestions to improve compliance and efficiency.

Internal audit enhances operational efficiency and compliance, and improves risk management. Furthermore, it offers stakeholders credibility and transparency in governance processes.

To ensure independence, standards usually require internal auditors to report directly to the Audit Committee or the Board of Directors. This reporting structure eliminates conflicts of interest, allowing for unbiased results.

The internal audit team conducts audits at various levels, based on risk and industry-specific needs. It performs annual audits, and it completes compliance or IT-oriented audits either quarterly or continuously.

Internal audit is relevant as it helps secure assets, enhance accountability, and boost confidence between management and stakeholders. Ultimately, it helps ensure long-term business success by avoiding fraud and inefficiency.

In preparation, the organization must ensure clear, structured records and adherence to policies and processes, and leadership must train employees to provide auditors with honest answers.”.

Internal audits in banking help prevent fraud, ensure compliance with regulations, and foster customer confidence. They safeguard property and maintain trust in one of the most controlled industries.